FastForward

to your next paycheque

FastForward

to your next paycheque

FastForward

to your next paycheque

Access a portion of your eligible employment or government benefit income before it even hits your bank account.

Access a portion of your eligible employment or government benefit income before it even hits your bank account.

Access a portion of your eligible employment or government benefit income before it even hits your bank account.

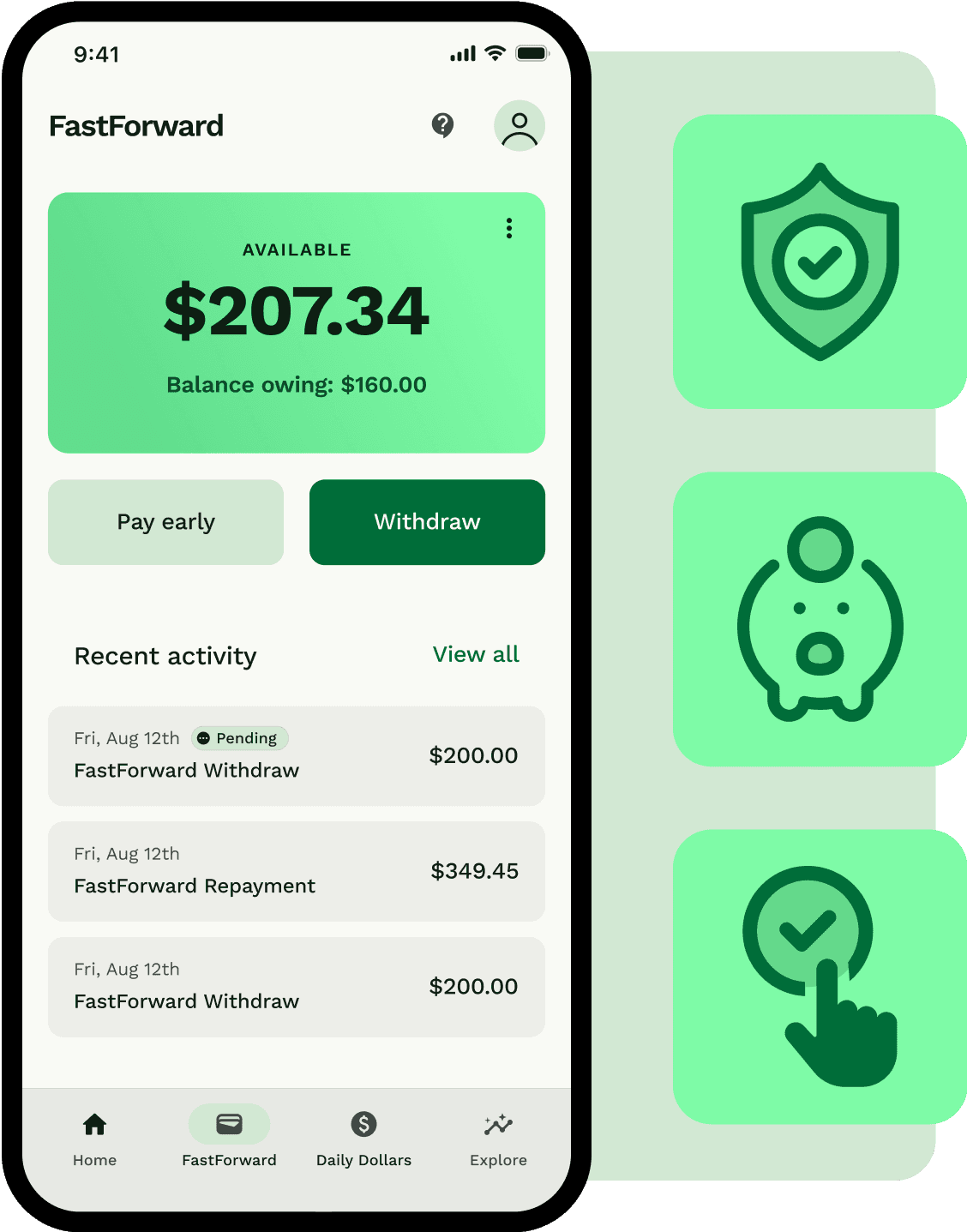

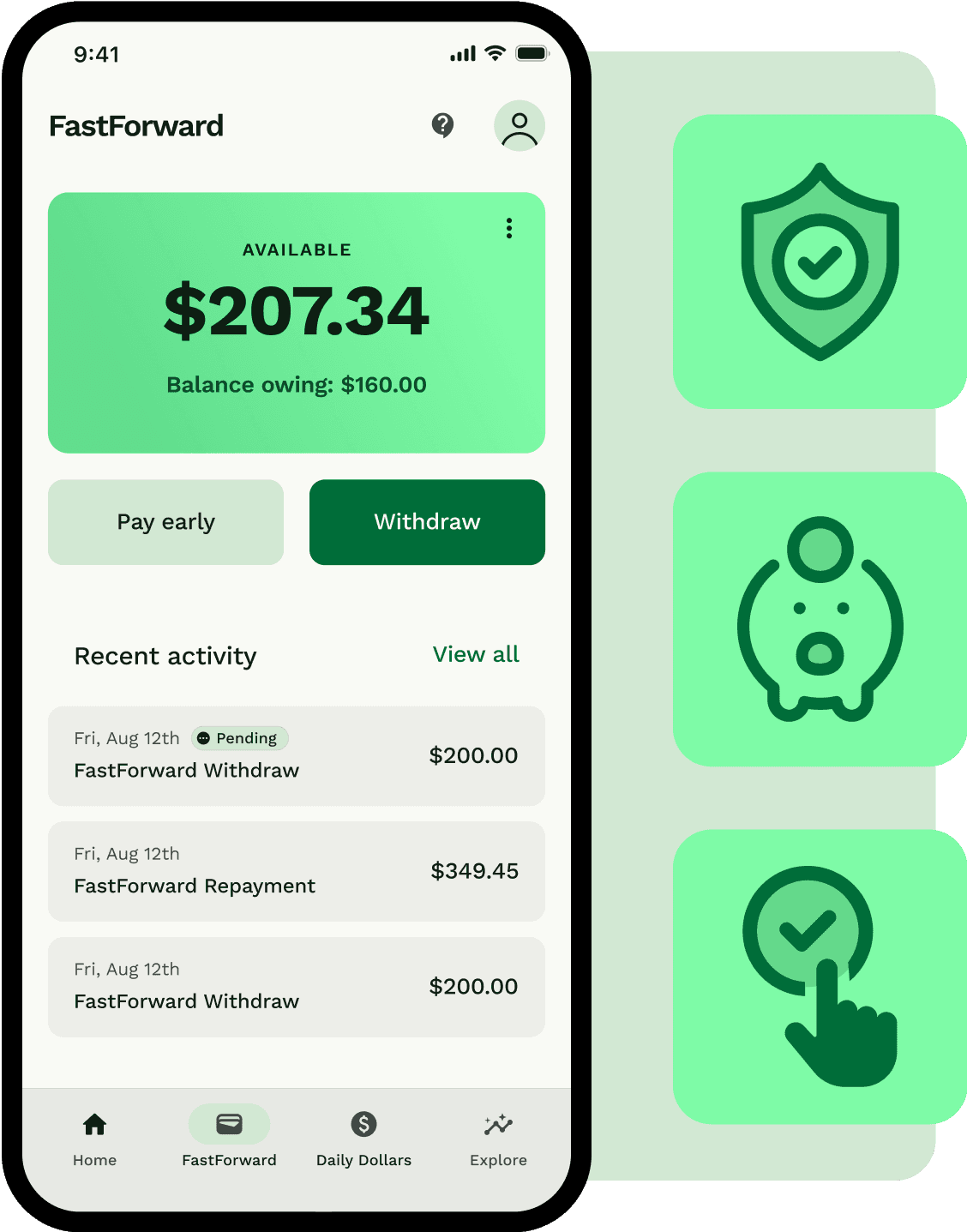

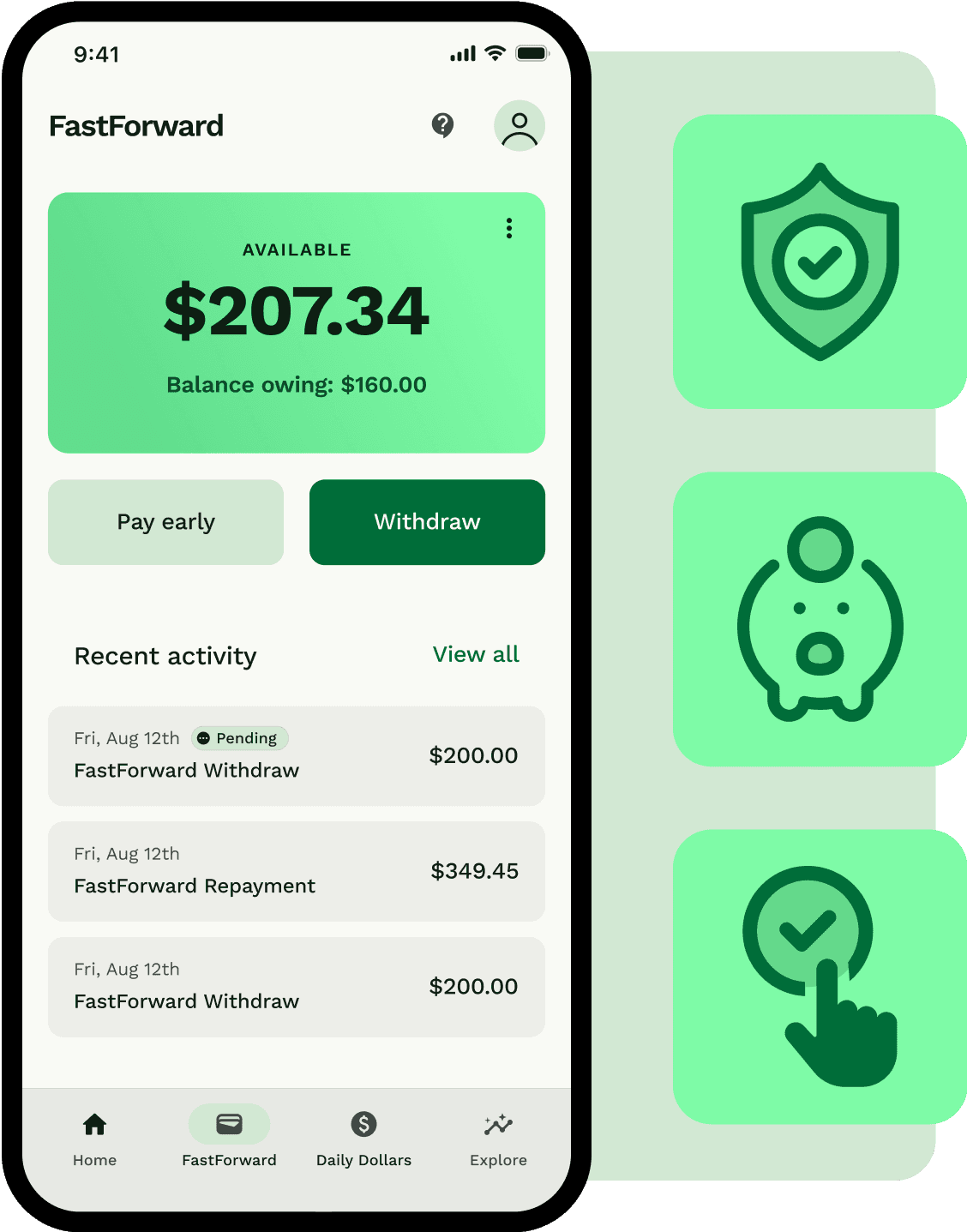

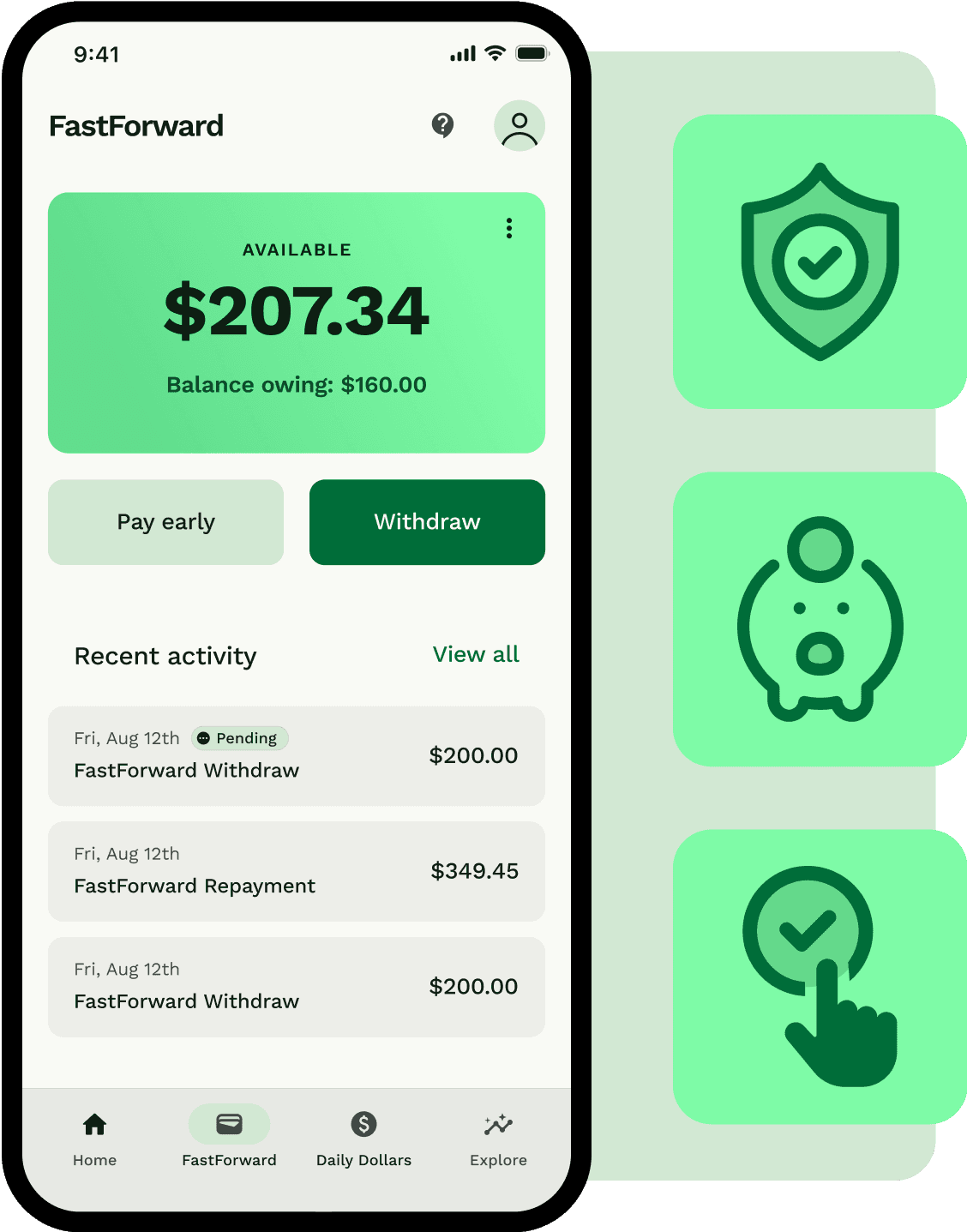

Instant credit. Anytime.

FastForward is an instant line of credit that offers a portion of your daily employment or government income (Canadian Pension Plan, Canadian Child Benefit) early. Access cash effortlessly, anytime, right from your phone. No stress, no fuss – just your money on your terms. Borrow, repay, and repeat up to your approved limit!

2.5%

Transaction fee

Pay up to $2.50 on every $100 you withdraw.

0%

Interest

There is no interest on anything you borrow, rest assured.

Zero

Credit checks

That’s right – No credit checks. No bank visits. No kidding.

Instant credit. Anytime.

FastForward is an instant line of credit that offers a portion of your daily employment or government income (Canadian Pension Plan, Canadian Child Benefit) early. Access cash effortlessly, anytime, right from your phone. No stress, no fuss – just your money on your terms. Borrow, repay, and repeat up to your approved limit!

2.5%

Transaction fee

Pay up to $2.50 on every $100 you withdraw.

0%

Interest

There is no interest on anything you borrow, rest assured.

Zero

Credit checks

That’s right – No credit checks. No bank visits. No kidding.

Instant credit. Anytime.

FastForward is an instant line of credit that offers a portion of your daily employment or government income (Canadian Pension Plan, Canadian Child Benefit) early. Access cash effortlessly, anytime, right from your phone. No stress, no fuss – just your money on your terms. Borrow, repay, and repeat up to your approved limit!

2.5%

Transaction fee

Pay up to $2.50 on every $100 you withdraw.

0%

Interest

There is no interest on anything you borrow, rest assured.

Zero

Credit checks

That’s right – No credit checks. No bank visits. No kidding.

Instant credit. Anytime.

FastForward is an instant line of credit that offers a portion of your daily employment or government income (Canadian Pension Plan, Canadian Child Benefit) early. Access cash effortlessly, anytime, right from your phone. No stress, no fuss – just your money on your terms. Borrow, repay, and repeat up to your approved limit!

2.5%

Transaction fee

Pay up to $2.50 on every $100 you withdraw.

0%

Interest

There is no interest on anything you borrow, rest assured.

Zero

Credit checks

That’s right – No credit checks. No bank visits. No kidding.

FastForward vs. Payday Loans

Skip the headache with a line of credit that actually moves you forward.

FastForward by MoneyUp

PayDay Loans

$5 min. required amount

$100+ min.required amount

Up to $2.50

Fees per $100

$14

Fees per $100

No credit check

No credit check

No branch visit

No branch visit

Bonus cash incentives

Bonus cash incentives

FastForward vs. Payday Loans

Skip the headache with a line of credit that actually moves you forward.

FastForward by MoneyUp

PayDay Loans

$5 min. required amount

$100+ min.required amount

Up to $2.50

Fees per $100

$14

Fees per $100

No credit check

No credit check

No branch visit

No branch visit

Bonus cash incentives

Bonus cash incentives

FastForward vs. Payday Loans

Skip the headache with a line of credit that actually moves you forward.

FastForward by MoneyUp

PayDay Loans

$5 min. required amount

$100+ min.required amount

Up to $2.50

Fees per $100

$14

Fees per $100

No credit check

No credit check

No branch visit

No branch visit

Bonus cash incentives

Bonus cash incentives

Your money, on the ready.

Access to money when you need it. Every month.

Days during loan period

Each day, a set amount of money becomes available to you, and you can either withdraw it or let it grow. Up to you!

Repayment date

On a fixed date each month, your full outstanding balance is due. You can setup pre-authorized debit or choose to pay early with an instant transfer for same-day access to your funds.

Your money, on the ready.

Access to money when you need it. Every month.

Days during loan period

Each day, a set amount of money becomes available to you, and you can either withdraw it or let it grow. Up to you!

Repayment date

On a fixed date each month, your full outstanding balance is due. You can setup pre-authorized debit or choose to pay early with an instant transfer for same-day access to your funds.

Your money, on the ready.

Access to money when you need it. Every month.

Days during loan period

Each day, a set amount of money becomes available to you, and you can either withdraw it or let it grow. Up to you!

Repayment date

On a fixed date each month, your full outstanding balance is due. You can setup pre-authorized debit or choose to pay early with an instant transfer for same-day access to your funds.

Your money, on the ready.

Access to money when you need it. Every month.

Days during loan period

Each day, a set amount of money becomes available to you, and you can either withdraw it or let it grow. Up to you!

Repayment date

On a fixed date each month, your full outstanding balance is due. You can setup pre-authorized debit or choose to pay early with an instant transfer for same-day access to your funds.

Start borrowing in minutes

Just 3 simple steps for cash in under 5 minutes.

Just 3 simple steps for cash in under 5 minutes.

Just 3 simple steps for cash in under 5 minutes.

Download app

Setting up your FastForward account is quick and easy in the user-friendly app.

Available for download around the clock, setting up your FastForward account is quick and easy in the user-friendly app.

Verify income

Link your bank account to determine your approved credit amount.

Simply link your bank account that receives a government benefit, and we’ll confirm your eligible income to determine your approved credit amount.

Access funds

Choose from 2 secure withdrawal options to get your money hassle-free.

Choose from three secure withdrawal options to get your money fast and hassle-free.

Customer stories

Customer stories

Customer stories

Customer stories

Questions? We have answers

Who can use FastForward?

Currently, FastForward is open to Canadian residents (excluding Quebec and Saskatchewan) receiving eligible government benefit (Child Tax and CPP) and employment income. We do plan to expand our features and products to help even more Canadians in the future. Stay tuned for updates!

Does applying for FastForward affect my credit score?

No! FastForward doesn't check your credit score to determine if you qualify for a loan. We know you’ve worked hard to maintain your credit, so rest assured that using FastForward won't impact your credit score one bit. Your payments may be reported to the credit bureau which may impact your credit score.

How much does it cost?

We've designed FastForward to be accessible and affordable. Downloading the app and setting up your account is free! Plus, we don't charge interest on your outstanding FastForward balance–just a small fee of up to 2.5% of the amount you withdraw. When requesting money, a small fee may apply to withdraw your balance if you opt out of the free option.

How does borrowing and repaying work?

Once approved for a FastForward instant line of credit, you can borrow up to your daily credit limit, repay and re-borrow as many times as you need. If you choose to make a withdraw on your line of credit, the minimum starts from as little as $5. The maximum amount you can withdraw depends on the daily credit limit available to you. Our Canadian financial partner, Flinks, scans your transaction history for regular deposits of eligible income. Our system will then review your information to calculate your approved Credit Limit. Only one source of government or employment income can be used to qualify. Your repayments are set on a fixed date during the month. On your repayment date, the full balance you've withdrawn, including any fees, will be automatically deducted from your linked bank account. Once we’ve received confirmation of successful repayment, you’ll be able to re-borrow again up to your daily credit limit. It's that simple and convenient!

Questions? We have answers

Who can use FastForward?

Currently, FastForward is open to Canadian residents (excluding Quebec and Saskatchewan) receiving eligible government benefit (Child Tax and CPP) and employment income. We do plan to expand our features and products to help even more Canadians in the future. Stay tuned for updates!

Does applying for FastForward affect my credit score?

No! FastForward doesn't check your credit score to determine if you qualify for a loan. We know you’ve worked hard to maintain your credit, so rest assured that using FastForward won't impact your credit score one bit. Your payments may be reported to the credit bureau which may impact your credit score.

How much does it cost?

We've designed FastForward to be accessible and affordable. Downloading the app and setting up your account is free! Plus, we don't charge interest on your outstanding FastForward balance–just a small fee of up to 2.5% of the amount you withdraw. When requesting money, a small fee may apply to withdraw your balance if you opt out of the free option.

How does borrowing and repaying work?

Once approved for a FastForward instant line of credit, you can borrow up to your daily credit limit, repay and re-borrow as many times as you need. If you choose to make a withdraw on your line of credit, the minimum starts from as little as $5. The maximum amount you can withdraw depends on the daily credit limit available to you. Our Canadian financial partner, Flinks, scans your transaction history for regular deposits of eligible income. Our system will then review your information to calculate your approved Credit Limit. Only one source of government or employment income can be used to qualify. Your repayments are set on a fixed date during the month. On your repayment date, the full balance you've withdrawn, including any fees, will be automatically deducted from your linked bank account. Once we’ve received confirmation of successful repayment, you’ll be able to re-borrow again up to your daily credit limit. It's that simple and convenient!

Questions? We have answers

Who can use FastForward?

Currently, FastForward is open to Canadian residents (excluding Quebec and Saskatchewan) receiving eligible government benefit (Child Tax and CPP) and employment income. We do plan to expand our features and products to help even more Canadians in the future. Stay tuned for updates!

Does applying for FastForward affect my credit score?

No! FastForward doesn't check your credit score to determine if you qualify for a loan. We know you’ve worked hard to maintain your credit, so rest assured that using FastForward won't impact your credit score one bit. Your payments may be reported to the credit bureau which may impact your credit score.

How much does it cost?

We've designed FastForward to be accessible and affordable. Downloading the app and setting up your account is free! Plus, we don't charge interest on your outstanding FastForward balance–just a small fee of up to 2.5% of the amount you withdraw. When requesting money, a small fee may apply to withdraw your balance if you opt out of the free option.

How does borrowing and repaying work?

Once approved for a FastForward instant line of credit, you can borrow up to your daily credit limit, repay and re-borrow as many times as you need. If you choose to make a withdraw on your line of credit, the minimum starts from as little as $5. The maximum amount you can withdraw depends on the daily credit limit available to you. Our Canadian financial partner, Flinks, scans your transaction history for regular deposits of eligible income. Our system will then review your information to calculate your approved Credit Limit. Only one source of government or employment income can be used to qualify. Your repayments are set on a fixed date during the month. On your repayment date, the full balance you've withdrawn, including any fees, will be automatically deducted from your linked bank account. Once we’ve received confirmation of successful repayment, you’ll be able to re-borrow again up to your daily credit limit. It's that simple and convenient!

Questions? We have answers

Who can use FastForward?

Currently, FastForward is open to Canadian residents (excluding Quebec and Saskatchewan) receiving eligible government benefit (Child Tax and CPP) and employment income. We do plan to expand our features and products to help even more Canadians in the future. Stay tuned for updates!

Does applying for FastForward affect my credit score?

No! FastForward doesn't check your credit score to determine if you qualify for a loan. We know you’ve worked hard to maintain your credit, so rest assured that using FastForward won't impact your credit score one bit. Your payments may be reported to the credit bureau which may impact your credit score.

How much does it cost?

We've designed FastForward to be accessible and affordable. Downloading the app and setting up your account is free! Plus, we don't charge interest on your outstanding FastForward balance–just a small fee of up to 2.5% of the amount you withdraw. When requesting money, a small fee may apply to withdraw your balance if you opt out of the free option.

How does borrowing and repaying work?

Once approved for a FastForward instant line of credit, you can borrow up to your daily credit limit, repay and re-borrow as many times as you need. If you choose to make a withdraw on your line of credit, the minimum starts from as little as $5. The maximum amount you can withdraw depends on the daily credit limit available to you. Our Canadian financial partner, Flinks, scans your transaction history for regular deposits of eligible income. Our system will then review your information to calculate your approved Credit Limit. Only one source of government or employment income can be used to qualify. Your repayments are set on a fixed date during the month. On your repayment date, the full balance you've withdrawn, including any fees, will be automatically deducted from your linked bank account. Once we’ve received confirmation of successful repayment, you’ll be able to re-borrow again up to your daily credit limit. It's that simple and convenient!